Be prepared for the next great transfer of wealth. Buy physical silver and storable food.

peakprosperity.com / by Alasdair Macleod / Monday, March 4, 2013, 2:52 PM

The Christmas and New Year break, when Europe shuts down and stops thinking, is now well and truly over, and we are reawakening to the same old problems: Greece, Spain, Cyprus, Portugal, Italy, France…… all with their hands out for money from Germany, Holland, Finland and Austria.

The holiday from the banking crisis, which was the result of the determination of the ECB to put a lid on it, is also over, with yields on the supplicant countries’ debt rising again.

However, joining the bad news list is the United Kingdom. Ominously, the pound is sliding in the foreign exchange markets, providing a very tricky background for Chancellor Osborne’s budget on March 20th. I shall examine the UK’s position later, but first let’s update ourselves on developments in the eurozone.

The reality is that all the problems of the eurozone are still with us, despite the fall in bond yields and their modest subsequent recovery. There is now the likelihood that we are about to enter the final phase of the end of the eurozone experiment, with far wider consequences. So we need to pick up the story where we left off.

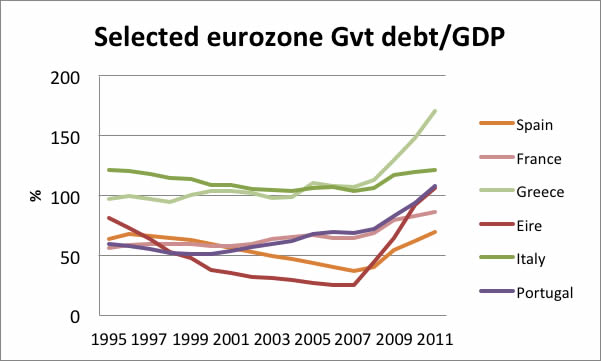

First, let’s look at the trend of government debt-to-GDP for selected countries (the numbers are from the ECB):

As we can see government deficits for these countries took off from the time of the banking crisis, and are still increasing beyond the charts’ cut-off point into 2012. They reflect poor economic performance, a lack of desire to slash government spending, and contracting bank credit. Only Spain and France were below Carmen Reinhart and Ken Rogoff’s tipping point of 90% government debt to GDP (see their book, “This time is different”); but in Spain’s case for 2012 if you add in €27bn raised to pay the backlog of bills incurred by regional governments, and the €40bn, so far and rising, to bail out the mortgage banks today Spain is closer to 100% debt to GDP, and France’s is now over 90%.

Thanks to BrotherJohnF